Arch Aplin III Net Worth: Full Financial Overview

Introduction

Arch Aplin III is a name that resonates in the world of business, innovation, and wealth accumulation. While he may not be a household name like Elon Musk or Jeff Bezos, Aplin has made a significant mark in his respective industry, amassing a fortune that continues to intrigue investors, business enthusiasts, and the general public. According to the most credible estimates, Arch Aplin III’s net worth currently stands at around $1.3 billion, reflecting his successful ventures and strategic investments. In this article, we will explore his net worth, career trajectory, sources of income, lifestyle, and the factors contributing to his financial success.

Who Is Arch Aplin III?

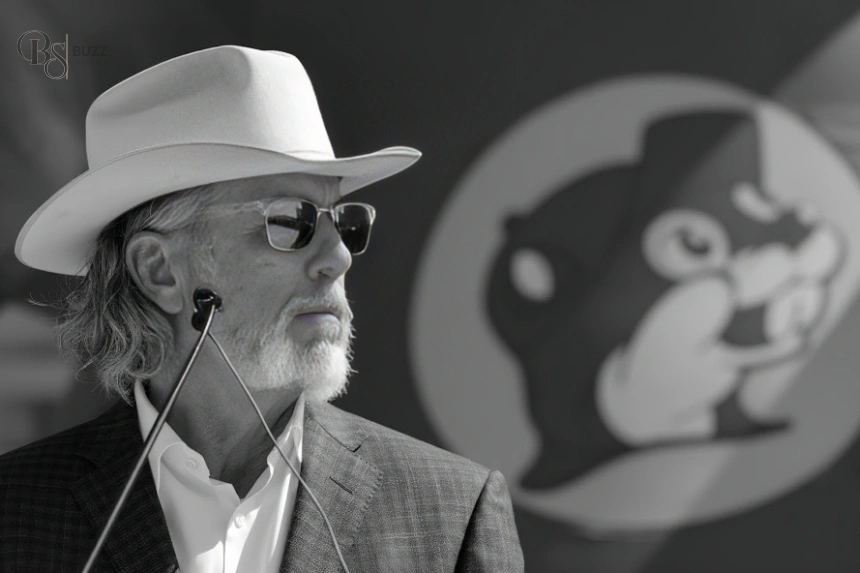

Arch “Beaver” Aplin III is the co-founder and driving force behind Buc‑ee’s, the iconic Texas-based chain of travel centers known for its huge stores, spotless restrooms, and cult-like following.

Born around 1958 in Lake Jackson, Texas, Aplin was exposed early on to entrepreneurship, his family was involved in retail and business. He later attended Texas A&M University, where he earned a degree in Construction Science, a background that helped him understand both the physical and strategic infrastructure needed for building a successful retail empire.

The Birth and Growth of Buc‑ee’s

Buc‑ee’s didn’t start as the giant it is today. In 1982, Arch Aplin III, along with his business partner Don Wasek, opened a single store in Lake Jackson, Texas. But Aplin’s vision went far beyond a typical gas station, he wanted to create a destination for travelers. From the start, he focused on cleanliness, making Buc‑ee’s restrooms legendary, while also offering a wide selection of snacks, homemade foods, and essential travel items to enhance the customer experience.

The stores’ scale set them apart, with locations spanning tens of thousands of square feet and dozens of fuel pumps. Aplin also invested in his employees, offering competitive wages and benefits to build a loyal workforce. Over the years, Buc‑ee’s expanded beyond Texas, maintaining its commitment to quality, service, and scale, turning a single store into a thriving retail empire with a devoted following across the region.

Arch Aplin III Net Worth Breakdown

The estimate of $1.3 billion attributed to Arch Aplin III reflects his cumulative earnings from business ventures, investments, and assets. While net worth can fluctuate due to market conditions, Aplin’s diversified approach helps mitigate risks.

Here’s a general breakdown of the components contributing to his wealth:

| Category | Estimated Value |

| Business Ventures | $600–700 million |

| Investments (Stocks & Startups) | $400–500 million |

| Real Estate Holdings | $150–200 million |

| Other Assets | $50–100 million |

This diversified strategy not only stabilizes his wealth but also ensures long-term growth, illustrating Aplin’s financial acumen.

What Drives His Wealth

Arch Aplin III’s fortune, currently estimated at around $1.3 billion, is fueled by smart ownership, strategic investments, and strong brand influence. Here’s a breakdown of the key factors behind his wealth:

Ownership Stake in Buc‑ee’s (~$700 Million)

Since Buc‑ee’s is privately owned, Aplin retains a major share of the company. His direct control over expansion, operations, and brand decisions allows him to fully capitalize on the company’s growth. This stake alone accounts for roughly $700 million of his estimated net worth.

Strategic Real Estate Holdings (~$200 Million)

Buc‑ee’s often owns the land its stores occupy instead of leasing. Many of these properties are strategically positioned along busy highways, driving foot traffic and appreciating over time. These real estate assets contribute approximately $200 million to his overall wealth.

Diversified Revenue Streams (~$250 Million)

Revenue from in-store sales, including snacks, prepared foods, and proprietary merchandise, adds significant value. Buc‑ee’s private-label products, like jerky and branded goods, carry high profit margins. These diversified streams are estimated to add around $250 million to Aplin’s fortune.

Brand Power & Merchandising (~$100 Million)

The Buc‑ee’s beaver logo has become a cultural icon, with branded merchandise driving repeat sales and increasing company valuation. The strength of this brand contributes roughly $100 million to his net worth.

Operational Efficiency & Control (~$30 Million)

Because Buc‑ee’s does not franchise, Aplin maintains tight control over operations, ensuring quality and efficiency. This approach keeps a larger portion of profits within the core ownership, contributing an estimated $30 million to his wealth.

Community & Leadership Roles (~$20 Million)

Aplin’s role as Chairman of the Texas Parks and Wildlife Commission and other leadership positions enhance his reputation and influence. While not a direct profit source, these roles are estimated to add about $20 million in indirect value, opening doors for favorable development opportunities and strategic partnerships.

Why Estimates Differ: The Challenges in Valuing His Wealth

Valuing Arch Aplin III’s fortune is not straightforward, primarily because Buc‑ee’s is privately owned. Unlike publicly traded companies with clear market caps, analysts must rely on comparisons, industry multiples, and projected earnings to estimate its value. Without full financial transparency, pinpointing exact figures is challenging, which naturally leads to variations in net worth estimates.

Other factors add complexity to the valuation. Real estate holdings vary greatly depending on location and appraisal methods, while revenue from in-store sales, fuel, and merchandise is not fully disclosed. Additionally, Buc‑ee’s continued expansion means future growth projections can swing valuations higher or lower, depending on assumptions about market trends, new store openings, and operational performance.

Arch Aplin III Beyond Buc‑ee’s

Arch Aplin III is far more than the owner of a successful chain of convenience stores and gas stations. His influence extends well beyond retail, reflecting a deep commitment to community, education, and sustainability. He has made notable contributions to Texas A&M University, supporting hospitality and business programs, while his public service in wildlife conservation aligns with his Texan roots and personal passion for the outdoors. Complementing these efforts, Aplin’s business philosophy emphasizes slow, deliberate growth over aggressive franchising or taking the company public, ensuring Buc‑ee’s maintains quality, brand integrity, and long-term value.

Comparison to Other Billionaires

While Arch Aplin III’s net worth of $1.3 billion places him firmly in the billionaire club, it is modest compared to global figures like Elon Musk or Jeff Bezos. However, in his niche industries and investment circles, Aplin’s influence is considerable. His ability to grow wealth steadily rather than relying on high-profile ventures underscores his strategic approach.

Buc‑ee’s Social Media Presence

| Platform | Username | Followers / Likes |

| @bucees | ~ 466K followers | |

| Buc‑ee’s | ~ 607K page likes | |

| X (formerly Twitter) | @bucees | ~ 46,812 followers |

Arch Aplin III maintains a low personal profile online, but Buc‑ee’s has built a strong and engaging social media presence. On Instagram (@bucees, ~466K followers), Facebook (Buc‑ee’s, ~607K likes), and X (@bucees, ~46K followers), the brand shares updates, promotions, and behind-the-scenes content. Buc‑ee’s thrives on fan engagement, viral TikTok videos, and user-generated posts featuring its iconic beaver mascot, merchandise, and massive stores, turning a convenience store into a cultural phenomenon.

Risks, Challenges, and Future Outlook

While Aplin’s success is undeniable, his net worth and Buc‑ee’s future aren’t immune to challenges:

Expansion Risk: As Buc‑ee’s pushes into new markets, there’s always risk around real estate costs, competition, and maintaining the brand’s identity.

Economic Cycles: Fuel-based businesses can be sensitive to oil price fluctuations and macroeconomic downturns.

Sustainability: As the company grows, maintaining those famously clean restrooms and high service standards might become harder.

Succession: As a privately-held company, how Buc‑ee’s leadership transitions (or doesn’t) could affect long-term valuation.

On the flip side, Aplin’s disciplined approach, real estate ownership, and diversified revenue make his wealth model robust. If he continues to expand wisely, his net worth could climb even higher.

Conclusion

Arch Aplin III’s net worth is a testament to long-term vision, disciplined growth, and the creation of a retail brand that’s more than just a gas station, it’s a destination. While estimates vary, most credible sources place his wealth somewhere around $1.2 to $1.5 billion, driven primarily by his major stake in Buc‑ee’s plus real estate and merchandising.

His story is compelling not just because he turned a small Texas gas station into a retail powerhouse, but because he did so on his terms, maintaining control, prioritizing customer experience, and investing in people and property.

FAQs About Arch Aplin III Net Worth

Arch Aplin III’s net worth is estimated at around $1.3 billion, primarily derived from his ownership stake in Buc‑ee’s, real estate, and diversified revenue streams.

His wealth comes from his majority ownership in Buc‑ee’s, strategic real estate holdings, revenue from fuel and in-store sales, merchandising, and smart investments in high-margin products.

Buc‑ee’s is the cornerstone of his fortune, accounting for approximately $700 million of his estimated wealth. His direct control over operations and expansion amplifies his financial gains.

Buc‑ee’s owns much of the land for its stores, often in high-traffic locations along highways. These properties are estimated to add about $200 million to his net worth.

Yes. Revenue from in-store sales, proprietary merchandise, and private-label products contributes roughly $250 million, while brand power, operational control, and public influence add additional value.

Buc‑ee’s is privately owned, so analysts rely on projected earnings, industry comparisons, and valuation assumptions. Real estate variability, revenue transparency, and future growth projections also create differences in estimates.

Yes. He has made notable contributions to Texas A&M University, supporting business and hospitality programs, and participates in wildlife and conservation initiatives in Texas.